Self Storage Equity Ramping Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

DESCRIPTION

Recently updated with assumptions for financing some of the initial costs with debt for each deal and added an IRR sensitivity for financing percentage and exit cap rate.

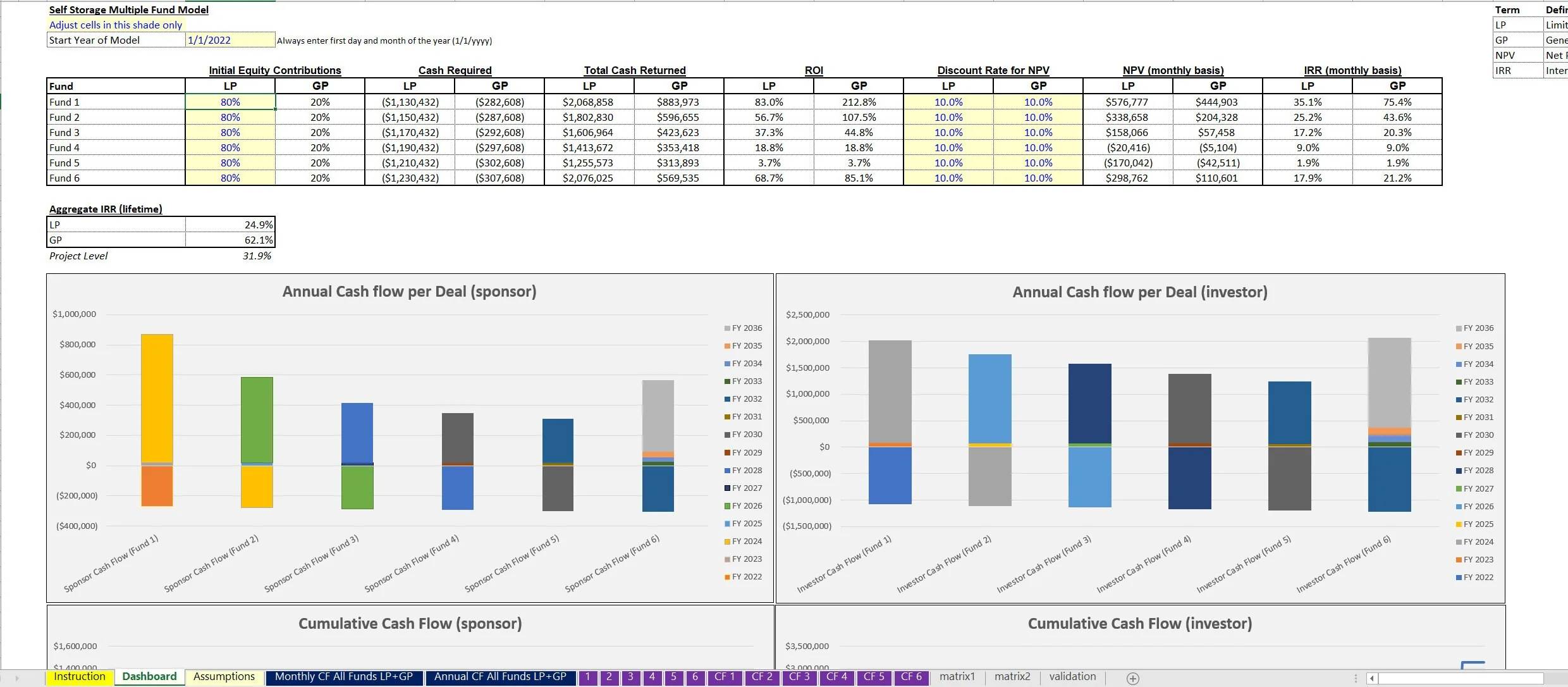

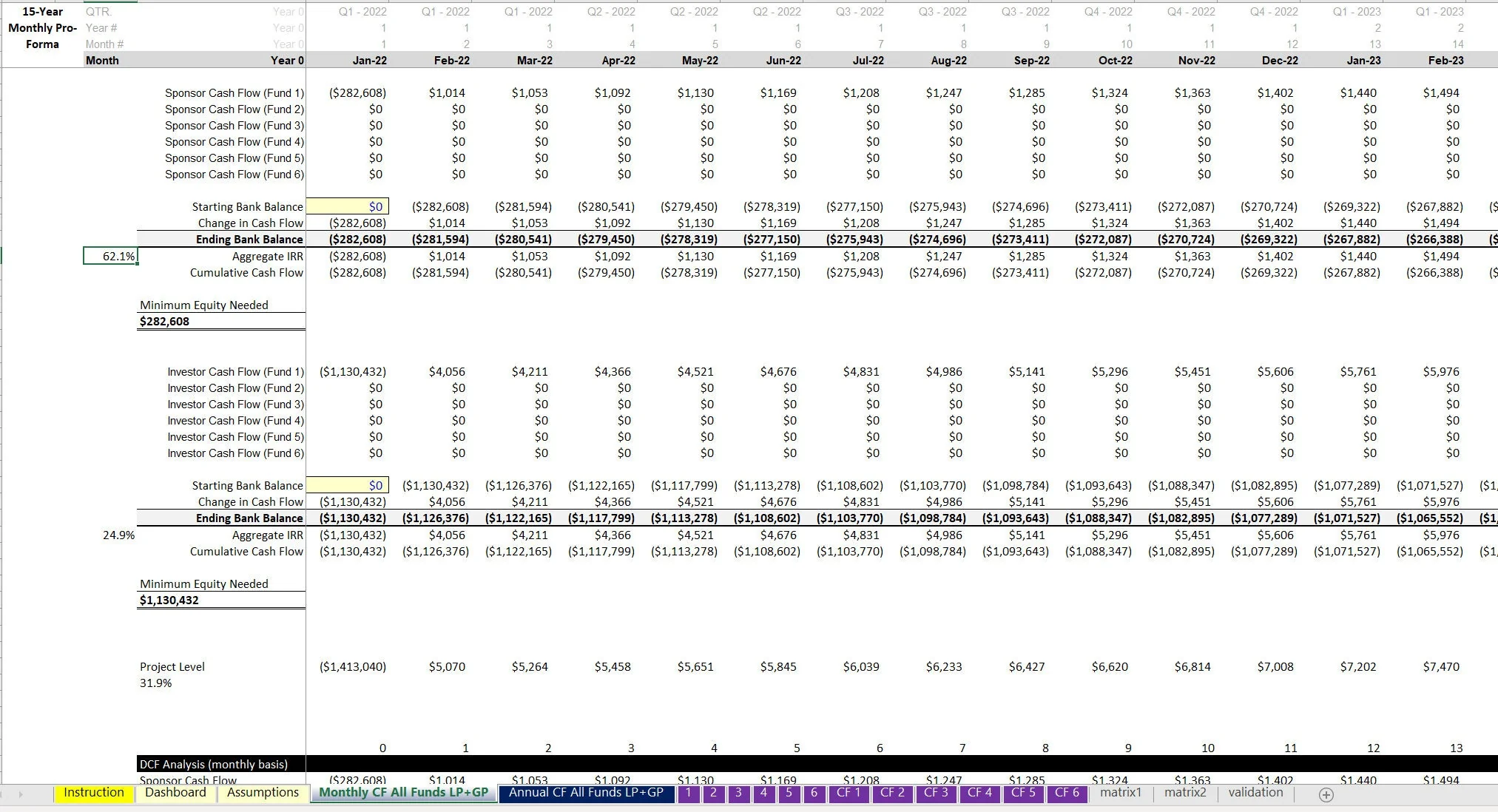

This is one of the most unique and useful self storage models that I have ever done. It was designed to be viewed from the perspective of a joint venture participant as either the Sponsor (GP) or the Investor (LP).

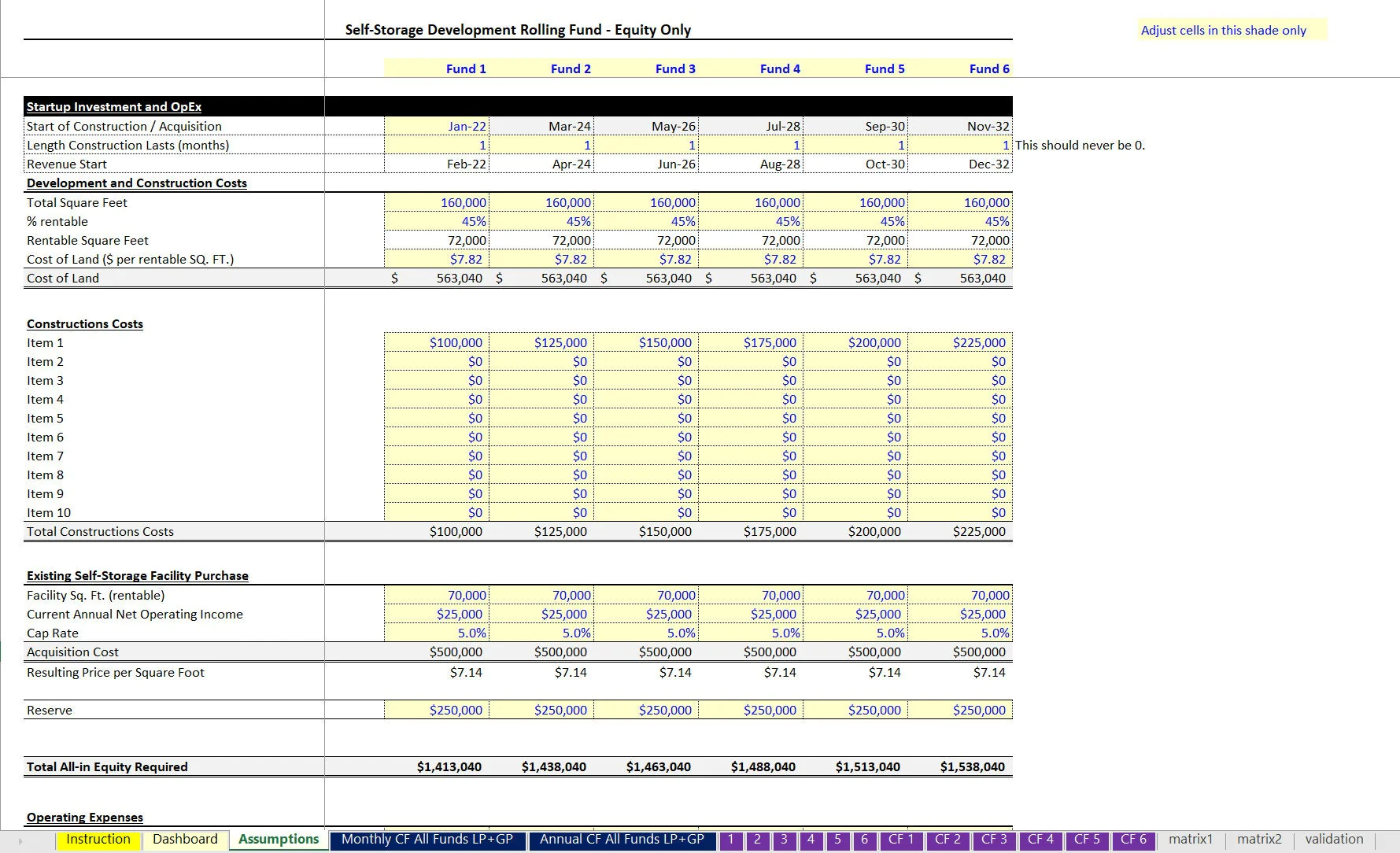

The assumptions let the user define acquisition and/or development configurations for up to 6 separate deals. The model assumes no senior debt and only equity investments are made. It doesn't have to be a joint venture if so desired. The percentage of cash distributions can be zeroed out accordingly.

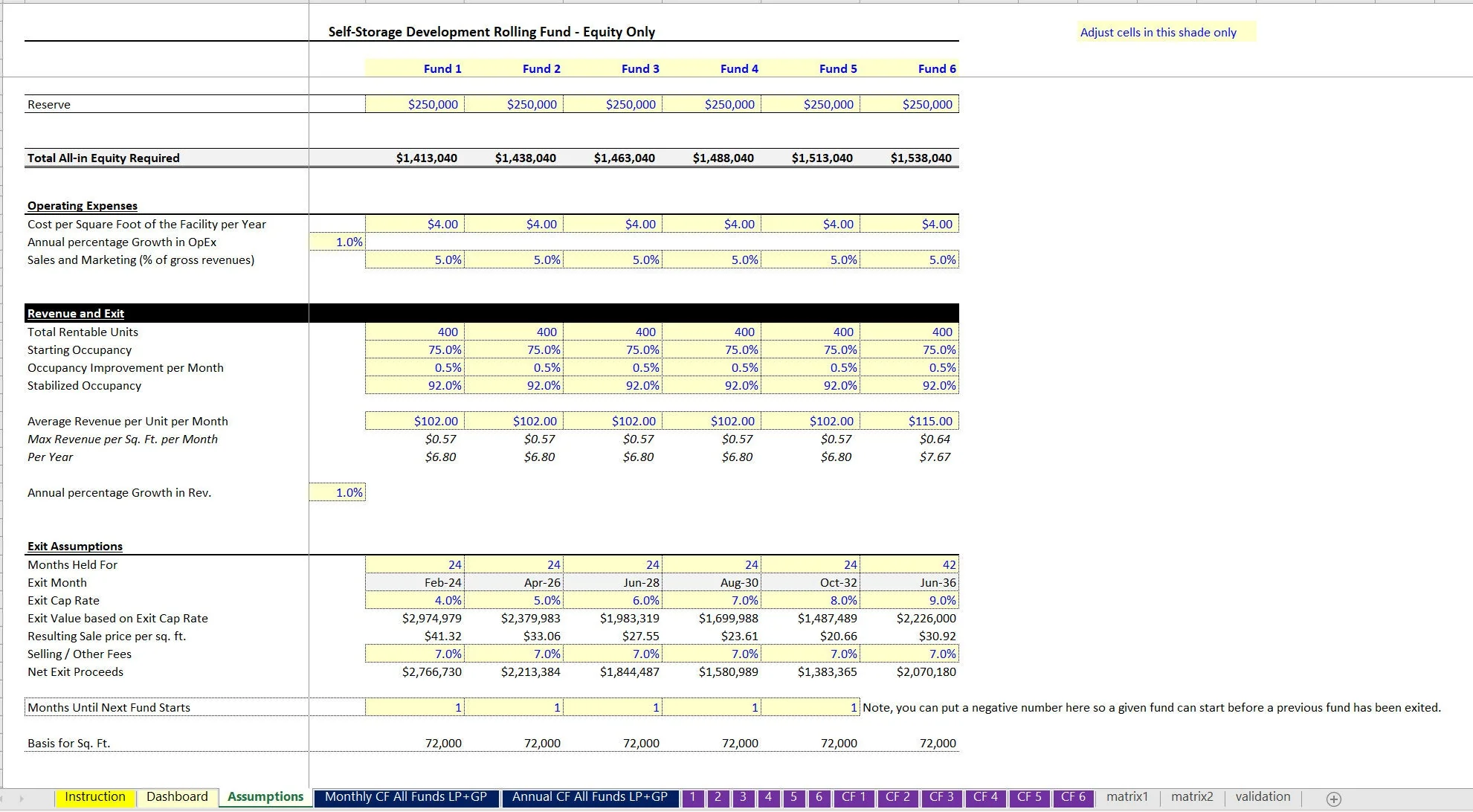

Each deal has its own configuration for:

• Start month

• Time from start until revenue begins

• Startup Costs

• Opex

• Unit Count / revenue

• Exit cap

• Month each deal starts relative to the previous one finishing

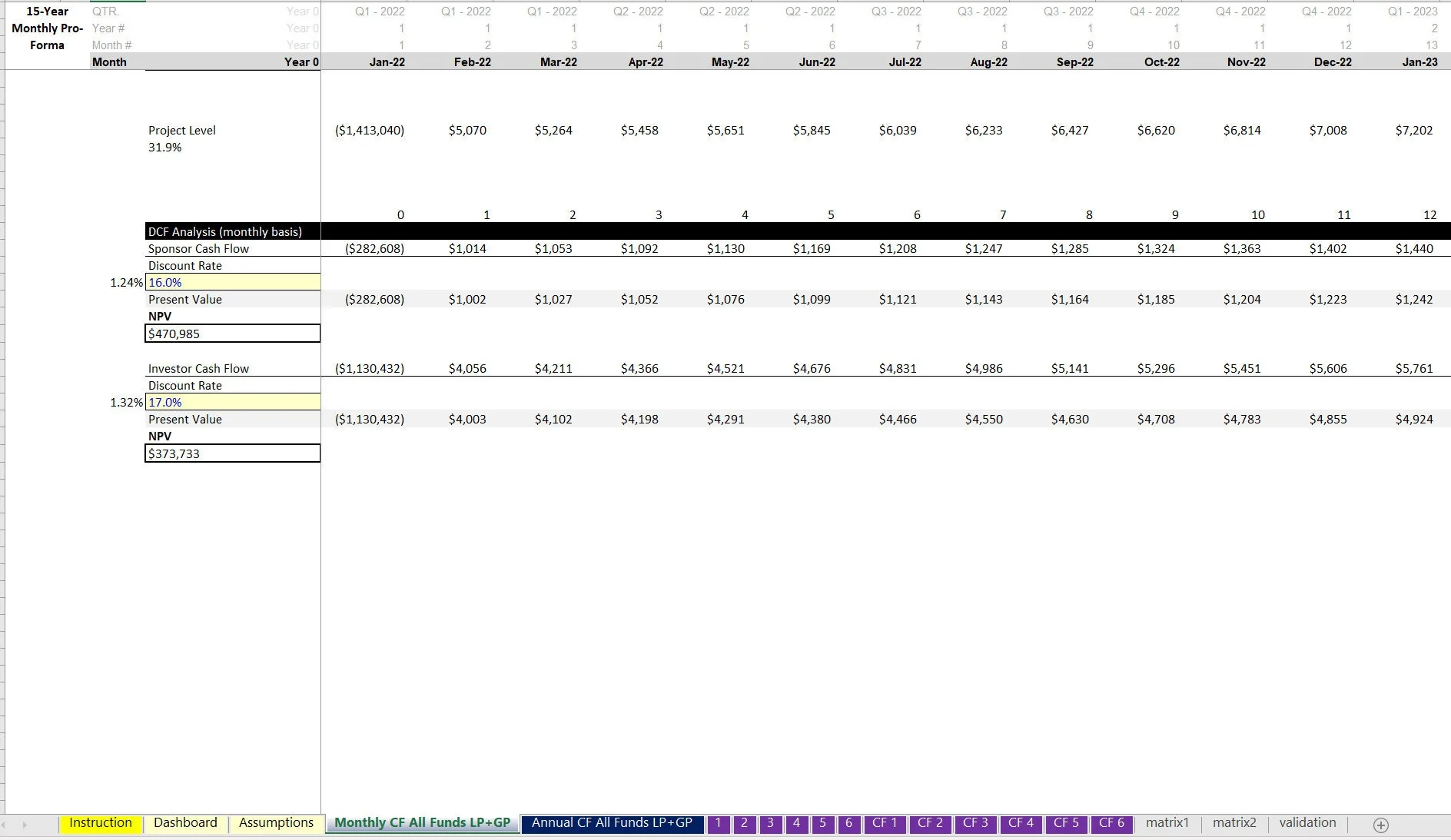

The deals don't have to happen one after the other and the assumptions can be configured so each deal starts at whatever month is desired. The model will show all deals on the same 16 year timeframe as well as within their own IRR Hurdle based joint venture waterfall.

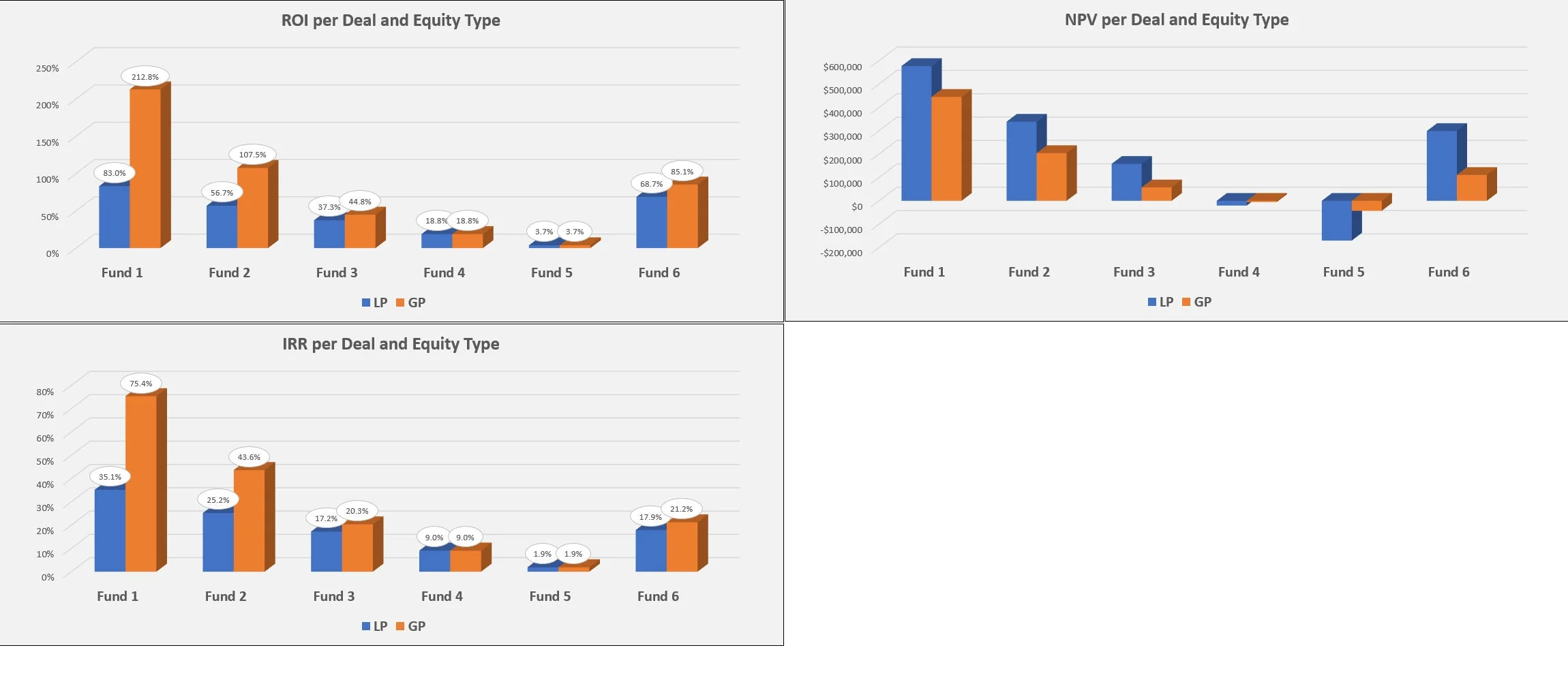

By separating each deal, the user can set different hurdle rates, equity contribution rates, and cash flow split rates. The point of the model is to see what starting capital can be turned into without adding any new capital over time.

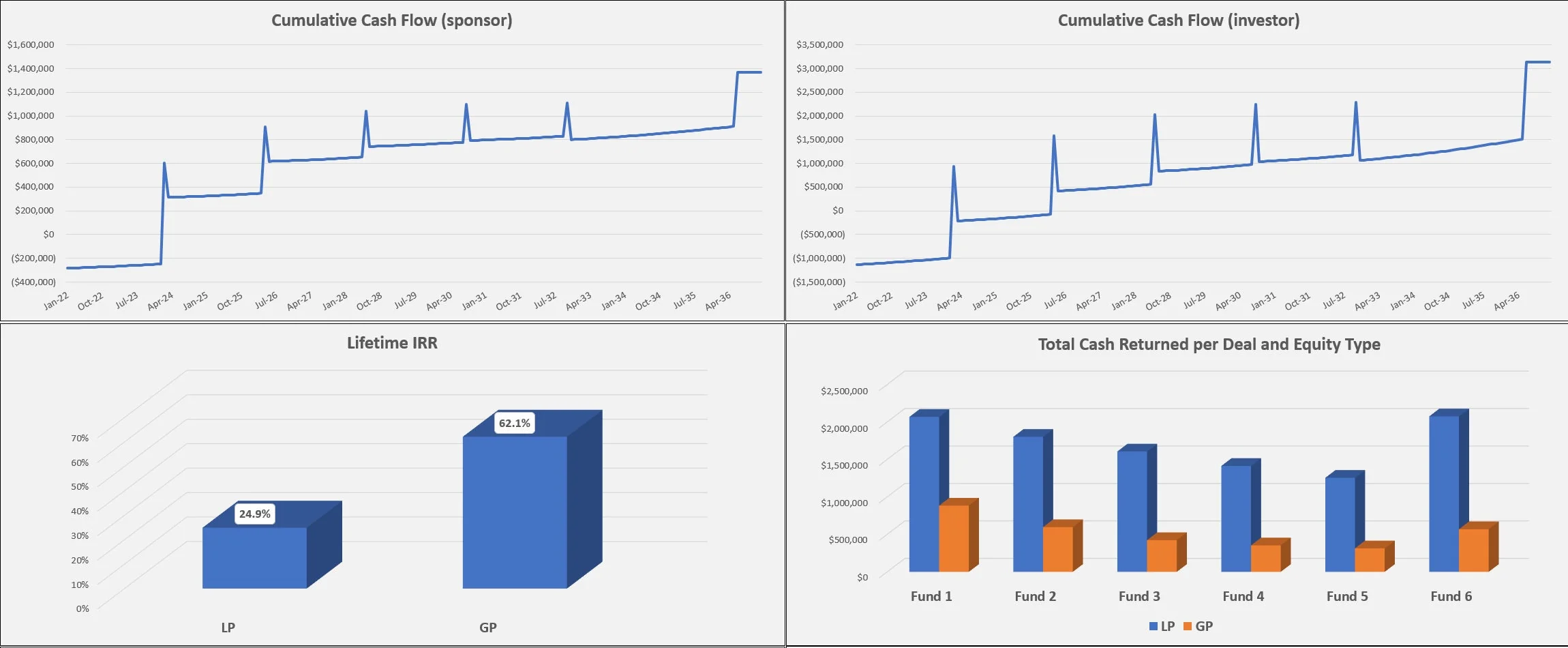

The idea being the user enters into the first deal, it runs for a determined number of months, there is an exit, and then the next deal is done. The cash flow is tracked across all deals so the user can see if there are any negative cash flow months besides the initial equity contributions. If so, that will show there is more equity required down the line and it will be deal dependent.

A dashboard was created for the major input assumptions of each deal and a separate DCF Analysis was done per deal and in aggregate. Things like sponsor / investor contribution rates and discount rates as well as final IRR, ROI, and NPV are displayed here.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model, Company Financial Model, Business Plan Financial Model, Real Estate Excel: Self Storage Equity Ramping Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Real Estate Underwriting Templates / Deal Analyzers

This bundle contains 25 total documents. See all the documents to the right.

Save %!

Industry-specific Financial Models (40+)

This bundle contains 58 total documents. See all the documents to the right.